Best Travel Insurance for Digital Nomads (Pros & Cons)

What is the best travel insurance for digital nomads? Traveling since 2020 full-time we got asked that question many times.

We have done tons of research, not only for this blog post but also for ourselves. Because as a digital nomad travel insurance is very important.

Spending a long time away from home increases the chance that you will need travel insurance. But many travel insurance providers cater to holidaymakers and not long-term travelers.

So we went on a quest to find the best digital nomad travel and health insurance we could actually sign up for. We will share the best we came across in this blog post!

7 Factors to consider when purchasing travel insurance for digital nomads

The best travel insurance is the one that covers your individual needs as a digital nomad. Because as a digital nomad, you will have different needs than the average traveler. So read on to find out what to look out for when choosing!

#1 Flexibility

In my opinion, this is one of the most important factors you should take into account when looking for an insurance provider.

Traditional insurance providers always ask for a fixed start and end date for your travels. They also ask what countries you are going to visit.

This is often impossible for nomads to answer because you may be going to many countries at a time like us. Plus your plans could change so it’s hard to plan in advance.

This is why it is great to have a provider that will allow you to be flexible about what countries you will visit, how long you can sign up for, and when or how you can cancel your membership.

#2 Where you can sign up from

As a nomad, you may be away from your home country for months or years at a time. We both are! But some insurance providers will only allow you to sign up for a plan from your home country.

This can be extremely inconvenient so it is best to look for a provider that allows you to sign up from anywhere in the world.

#3 Deductibles

A deductible is an amount you have to pay before your insurance provider will start paying your bills.

An example: You have a $800 dollar hospital bill and your deductible is $250. You will have to pay $250 and your insurance provider will pay the rest.

Some insurance providers will offer zero deductibles but then you have to pay a higher monthly rate. While others will offer higher deductibles with lower monthly rates. This one is up to your preferences.

#4 Loss or theft of luggage covered

As a nomad, I think one of the crucial areas that you want to be covered for is the loss or theft of baggage. We don’t own anything else than our luggage so it’s very important to us.

Most of us also rely heavily on our laptops and other electronics to make a living so you want to make sure your insurance provider will cover you.

Many plans will only cover medical treatments so you need to read the terms to make sure loss, damage, or theft of personal possessions is covered if that’s of interest to you.

#5 Adventurous activities covered

If you are planning on doing sporty activities such as skydiving, bungee jumping, diving, rafting, and skiing then you want to make sure that your plan covers injuries arising from these activities.

Many travel insurances for digital nomads do not cover these activities and it could leave you with a very big hospital bill if you get in trouble in the wrong country.

Which activities you would like to have included is highly individual. So make sure to read the terms of each plan to see exactly what is covered.

#6 Ease of making a claim

Trying to make a claim is usually the worst part of dealing with insurance companies. They are usually quick to take your money and slow to give it back to you when you need it!

So you want to pick a provider that has a proven track record of paying out claims and not making you jump through thousands of bureaucratic hoops.

I have read through many reviews to assess how reliable the insurers are in paying out claims and to get an idea of what the best travel insurances for digital nomads are in practice.

#7 Review Score

How can you know if the insurance is a good one? Read the reviews! Tons of reviews. Because the best way to judge a provider is by knowing what real customers are saying.

I went through hundreds of reviews to see if companies are reliable, keep their promises, and offer an overall good customer experience. Because if you need them it shouldn’t be an extra burden.

I mainly checked Trustpilot and if they were not on there I check other review sites. So with all the factors out of the way let’s check out my list of the best travel insurance for digital nomads.

1. SafetyWing (Overall best travel insurance for digital nomads)

SafetyWing is a newcomer to the insurance scene but has become very popular recently. We have chosen SafetyWing because it is one of the best travel insurance for digital nomads.

One of the best things about SafetyWing is that it was specifically made for digital nomads. This means that it is super flexible and you can sign up from anywhere in the world.

When you sign up you only pay for the first month. Your contract will then auto-renew every month and the payment will be taken from your bank account. That means you can cancel or pause anytime.

SafetyWing Pricing

Plans start at about $45 per month and cover you everywhere in the world excluding the US. You can get coverage for the US but it will almost double the price.

What is covered?

- Max medical coverage $250,000

- Emergency dental care up to $1,000

- Physical therapy and chiropractic care up to $50 per day

- Lost checked luggage up to $3,000

- Travel delays of up to $100 per day

SafetyWing Reviews & Our Experience

SafetyWing has a Trustpilot score of 4.2. Some reviews complain that the claim process is slow and communication is not the best. But so far we only had a good experience.

We already filed a claim with SafetyWing nomad insurance and although it wasn’t the smoothest process we received compensation for our claim quickly.

We also had fast and friendly customer service via live chat on their website. A feature we both love – no exhausting email threads or phone lines!

SafetyWings sign-up process is also super easy and straightforward. No bureaucratic hoops to jump through or endless papers to fill out. You can get your digital nomad insurance in under 15 minutes.

Pros

- Can sign up from anywhere fast

- Super flexible with pausing and canceling

- Low monthly rate

- 24/7 live chat

- Made for digital nomads

Cons

- New Company

- People reported a hard time filing claims

- No coverage for lost, stolen, or damaged possessions

- Quite a high deductible $250

👉 Check out SafetyWing travel insurance for digital nomads here or calculate your price here 👇

2. Genki (Best cheap digital nomad health insurance)

Genki is another newcomer to the scene that has a very similar setup to SafetyWing. They have also been created for digital nomads and allow you to sign up at any time from anywhere in the world.

They are operating since March 2022 so they are a very new company. Genki was started by a group of young people working in tech so they realize the needs of digital nomads. Many of the team at Genki are themselves digital nomads which is another bonus.

With Genki nomad insurance, you can only receive medical coverage. So if you want coverage for things like trip delays or lost luggage SafetyWing is the better option.

But if you are looking for the best digital nomad health insurance then Genki may be a great and cheap option for you.

Genki Pricing

Genki has different monthly costs depending on your age. If you are aged 0-29 years then you will pay $40 a month. The next age bracket is 30-39 years where you will pay $55 euros a month.

Genki also has a fairly low deductible of $50 per case. But you will have to pay this deductible for every claim so if you make multiple claims it could add up.

What is covered?

- No cost limit for medical care

- Coverage for dental care up to $1,000

- Treatment for sports injuries unless they are listed under dangerous activities

Genki Reviews

Genki has a score of 4.3 on Trustpilot. There are a few negative reviews from people having trouble making claims. But since it is a brand new company there is room for improvement.

Pros

- Made for digital nomads

- Cheap monthly rate

- Flexible, can cancel anytime

- Low deductible

Cons

- Only covers medical expenses

- People reported that it is hard to file claims

- Very new company (2022)

👉 Check out Genki travel insurance for digital nomads here 👈

3. Heymondo (Best digital nomad medical insurance)

Heymondo is a well-established insurance provider that offers some of the best health insurance for digital nomads.

It is not quite as cheap or flexible as SafetyWing or Genki but it is still a great option. Heymondo has wider coverage options and a greater ability to customize your plan.

You can for example opt to cover yourself for loss, damage, or theft of your electronics. This will cost extra but will be of peace of mind to many digital nomads if they own expensive electronics.

Heymondo also offers a 24/7 medical chat for members. So as soon as you have a medical emergency you can contact them and they will direct you to the nearest appropriate medical facility. Handy!

Heymondo Pricing

Option 1: Long Trip Plan

The Long Trip Plan is the best plan for digital nomads on Heymondo and costs about $47 per month. If you include travel to the US this goes up to about $76 per month. You must book your insurance for a minimum of 90 days and then the plan renews as you like.

Option 2: Annual Multi-Trip

The Annual Multi-Trip is great if you plan to do lots of small trips from your home country. You can get worldwide coverage for as little as $240 per year.

This plan is only available to you if do not spend more than 60 days in a row outside your home country. So if you do a few trips per year it is a great plan with great benefits.

What is covered?

- Emergency medical and dental up to $2,500,000

- Lost or damaged baggage up to $1,200

- Up to $350 for costs incurred to travel disruptions such as missed or canceled transfers

- Natural disaster coverage up to $1,250

Heymondo Reviews

Heymondo has a score of 4.5 on Trustpilot from about 1,700 reviews. So it has a proven track record of being a reliable company.

Pros

- Well-established company, good reviews

- Coverage for theft, damage to baggage

- Potential to get coverage for electronics

- 24/7 medical chat for emergencies + app

- Wide range of sports covered, plus you can upgrade to cover adventure activities

Cons

- Not super flexible

- Quite a big deductible $250

- The minimum period is 90 days so not as convenient for shorter trips

👉 Check out Heymondo travel insurance for digital nomads here 👈

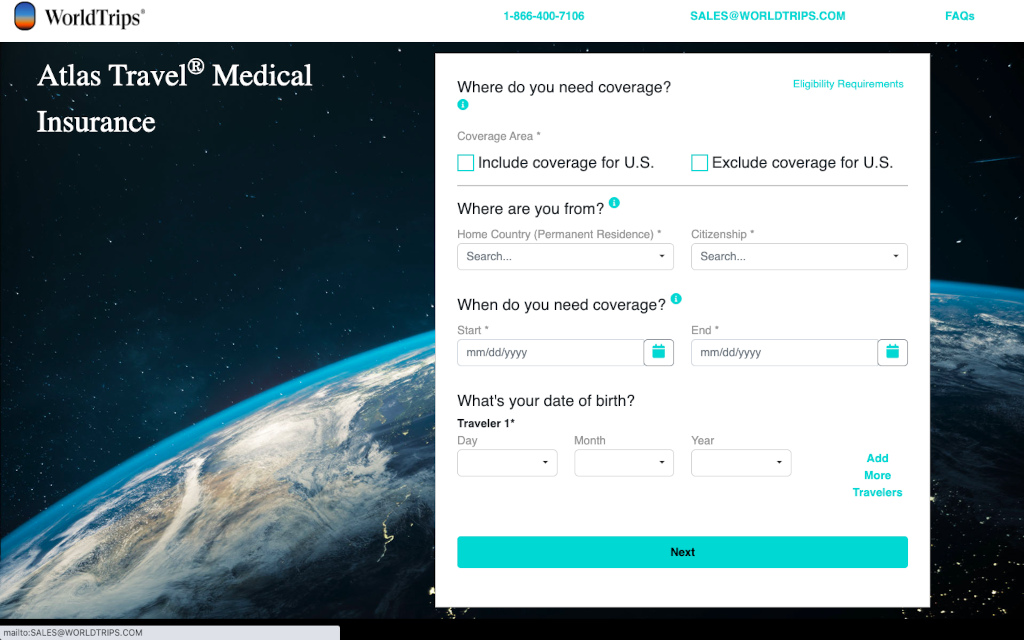

4. Atlas Travel Insurance by World Trips (Highly customizable)

Atlas Travel Insurance is a company that has been around for many years with a great reputation. They are not focused primarily on digital nomads but have plans that can be tailored to your needs.

They are suitable for digital nomads as their plans are available to citizens of most countries and you can sign up anywhere.

When signing up to Atlas you will have to select what countries you will be visiting. You will also have to select the time in which you are traveling.

So it is not super flexible in terms of signing up and canceling but you will have a broader range of coverage. For example, you will receive $100 for a lost passport and up to $10,000 to fly home when a close relative passes away.

You will not get these benefits on SafetyWing, Heymondo or Genki, so if you prefer these benefits over flexibility, then Atlas Travel Insurance may be for you.

Atlas Travel Insurance Pricing

When choosing a plan with Atlas the monthly price will depend on what choices you make. But when I selected different countries and deductible amounts it usually came to around $50 per month.

Considering the benefits you get from Atlas I think that this is a very reasonable price.

What is covered?

- You can choose from $50,000, $100,000, $250,000 or $500,000 max coverage

- Emergency dental up to $300

- Lost luggage $1,000

- Lost passport $100

- Up to $10,000 to return home after the death of a close relative

Atlas Travel Insurance Reviews

Atlas Travel Insurance has a score of 4.6 from over 2,000 reviews on InsureMyTrip. So they seem like a very reliable company with great customer service.

Pros

- Available to all nationalities

- Can sign up from anywhere

- A well-established company that has been around for many years

- The plan is very customizable

- You can choose to pay no deductible

Cons

- Not flexible, you have to choose countries you are visiting and travel time period

- Low dental coverage compared to other plans

👉 Check out Atlas travel insurance for digital nomads here 👈

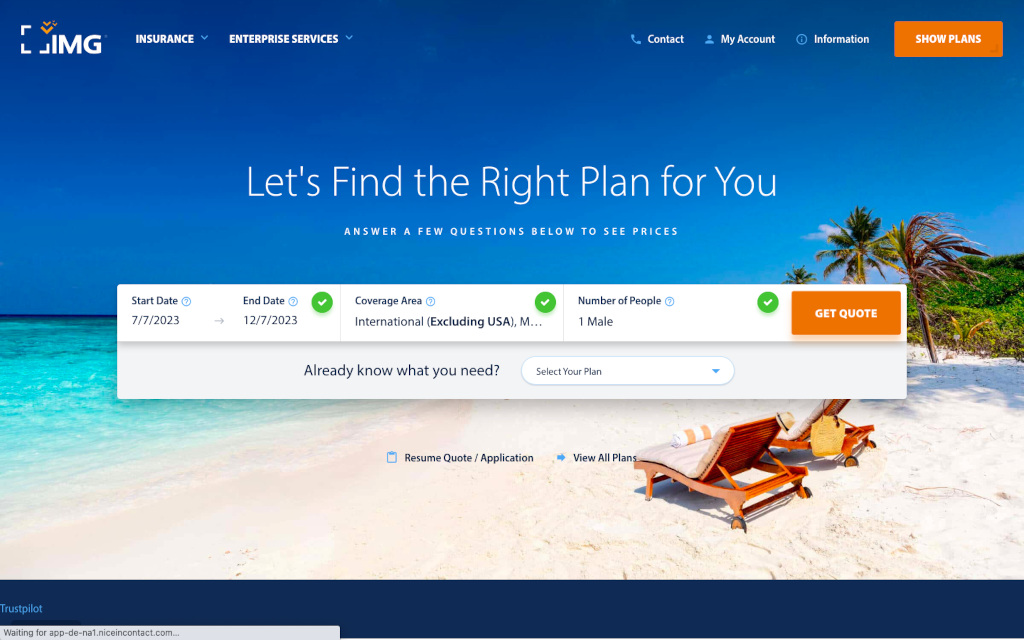

5. IMG (Best nomad travel insurance with lot of coverage)

IMG is an international insurance provider that serves over 190 countries and has been operating for over 25 years. They offer a wide range of insurance options for all types of needs.

The two plans they offer that are the best for digital nomads are the Patriot International Lite and the Patriot International Platinum plans.

IMG Pricing

The Patriot International Lite Plan which will cover most digital nomads needs costs about $50 per month. The Patriot International Platinum Plan is about $72 per month.

The main difference between the plans is that the Lite Plan has a policy maximum limit ranging from $50,000 to $1,000,000. Whereas Platinum has maximum limits from $2,000,000 to $8,000,000.

The amount you pay will increase depending on what maximum limit you want for your insurance.

The Lite Plan can be extended up to 24 months whereas the Platinum Plan can be extended up to 36 months. So apart from the medical max limits and renewal period, the plans are quite similar.

What is covered?

- Medical maximum $50,000 to $8,000,000 depending on your plan

- Deductible $0 to $25,000 depending on what you choose

- Emergency Reunion with selected family member $100,000

- Return travel home for the death of a close relative $10,000

- Dental care $300. For emergency dental care coverage up to plan maximum

- Lost luggage $50 per item and $500 in total

There are also some optional coverage options such as cell phone coverage. For just $90 you can be covered for loss, damage, or theft of your cellphone.

IMG Reviews

IMG has a score of 4.6 on Trustpilot from over 7,000 reviews. So you can see that it is a reliable company with a large customer base.

Pros

- The company exists for a long time

- Available to citizens of all countries

- Can choose to have zero deductible

- Plans are customizable

Cons

- Not flexible, have to choose travel dates

- Can not pay by the month or pause plan

👉 Check out IMG travel insurance for digital nomads here 👈

6. True Traveller (Best travel insurance for digital nomads from UK and EU)

True Traveller is a trusted insurance provider with some of the best travel insurance for digital nomads if you are from the UK or the EU. Unfortunately is not available for citizens outside of these regions.

The insurance plans they offer are created by travelers for travelers and you can really see that in the options they offer.

For example, they offer plans for people taking gap years or doing working holidays in Canada. So it is not just great for digital nomads but all travelers in general.

What stood out to me was how customizable True Traveller’s plans are. You can choose to ensure yourself for winter sports, lost stolen possessions, trip delays, and more.

So if there is something particular that you want to be insured for then True Traveller is a good option.

True Traveller Pricing

The Basic Plan costs around $50 per month and will give you all the basic health care coverage you need. It comes with zero deductible so you will not have to pay anything if you make a claim.

True Traveller also has Plus plans which more comprehensive coverage for a slightly higher price.

What is covered?

There are three main plans available for digital nomads. The below table displays the main areas of coverage of the three plans. For a more detailed list of coverage, you will have to visit their website.

| True Value | Traveller | Traveller Plus | |

| Medical Expenses | €10,000,000 | €10,000,000 | €10,000,000 |

| Baggage (optional) | €1,200 | €2,500 | €3,000 |

| Cancellation | €1,200 | €3,500 | €9,000 |

| Personal Liability | €1,000,000 | €2,000,000 | €2,000,000 |

True Traveller Reviews

True Traveller has a 4.8 on Trustpilot from over 3,000 reviews. Which is a really good score considering the number of reviews.

Overall customers in the reviews seemed to be very happy with the claims process. So True Traveller seems like a trustworthy insurance provider that is easy to deal with.

Pros

- Customizable plans

- Very good reviews

- You can sign up while traveling

- You can choose to have zero deductible

Cons

- Only for UK and EU citizens

- Not super flexible if you want to cancel or pause your plan

👉 Check out True Traveller travel insurance for digital nomads here 👈

7. Insured Nomads (Best insurance for adventurous remote workers)

Insured Nomads offers a wide range of plans for digital nomads with varying needs. You can get coverage for entering a warzone! So if there are any digital nomads out there wanting to go off track then this is the insurance for you.

But the plan that most people will want is the World Explorer Plan which offers medical insurance for single trips from 7 to 364 days.

This plan offers the usual medical coverage that does not differ too much from other providers. But one thing that stood out to me was that if your flight is delayed you get free use of an airport lounge which is a great feature.

There is also a World Explorer Guardian Plan which includes cover for costs associated with having to cancel a trip. But this is only available to US citizens. However, it could be a good option if you are booking an expensive trip such as a safari, and are worried it may be canceled.

Insured Nomads Pricing

On the Insured Nomads website, they state that the typical cost for the World Explorer Plan is about $86 per month. But this price will vary depending on your age, nationality, etc.

What is covered?

- Medical expenses up to $2,000,000

- 24-hour emergency medical care

- Acute onset of a pre-existing condition

- Airport lounge access

Insured Nomads Reviews

Insured nomads have a score of 4.1 on Trustpilot from 90 reviews. So considering the number of reviews it is not the best score but also not highly representable. Room for improvement!

Pros

- Wide range of plans for specific needs

- Available to citizens of all countries

- You can sign up while abroad

Cons

- Not Flexible

- More expensive than other plans

- Newer company so might not be as reliable

👉 Check out Insured Nomads travel insurance for digital nomads here 👈

8. Passport Card (Medical treatment on a debit card)

Passport Card is a new insurance provider with a unique concept. When you sign up for Passport Card you receive a debit card.

If you need some medical treatment you call Passport Card and they will preload your card with money and then you pay directly with the card.

This is really convenient as you do not have to pay out of pocket and wait for a refund from the company. Passport Card is however a very new company without a proven record yet.

Passport Card Pricing

The pricing per month depends on what country you are traveling to and what deductible you choose. The plans seem very expensive: For a 35-year-old male (me) with worldwide coverage, it would cost $289 a month with zero deductible.

The zero deductible is great but you will pay much more in a year ($3,000) than for SafetyWing, Genki or Heymundo ($600). So you have to check if the coverage is worth it for what you need.

What is covered?

- 24/7 telemedicine services

- Medical care up to $1,000,000 on the basic plan

- Dental care up to $3,000 for pain relief

- Vaccinations up to $100

- Up to 5 physiotherapy visits per year

Passport Card Reviews

Passport Card has only a score of 3 on Trustpilot from less than 50 reviews. The pre-load concept is great but at this point in time, you may take a risk in being one of their first customers.

Pros

- Convenient system

- No out-of-pocket expenses

- 24/7 support line

- No deductible

Cons

- Very high monthly rates

- Not flexible

- Does not have the best reviews

- No coverage for lost baggage or missed flights. Only medical coverage

👉 Check out Passport Card travel insurance for digital nomads here 👈

9. World Nomads (Not recommended anymore)

World Nomads used to be well-respected with the best travel insurance for digital nomads. They have been operating for around 20 years but during Covid, they stopped accepting new customers.

They have started accepting new customers but from the recent reviews I have been reading, it seems like they are not doing a good job anymore.

For the last 6 months, every review that I read was a one-star. Customers claimed that they could not get in contact with World Nomads and that the customer service was terrible.

The reason that I have added it to this list is that I have seen many people still recommending World Nomads. It was also the insurance we initially wanted to sign up for before choosing SafetyWing.

One of the big benefits of World Nomads is that they cover you for a wide range of sporting activities. You are also covered for loss, damage, and theft of possessions in certain situations which is great.

Another great advantage is that you are covered if you have to cancel your trip. But based on all the negative reviews they have received recently, I do not think it is worth the risk to sign up with them.

World Nomads Pricing

I selected the standard plan for World Nomads and it came up to about $85 per month. You can choose the Explorer plan which gives you much more coverage for about $125 per month.

What is Covered?

- Medical expenses up to $5,000,000

- Dental care up to $1,000

- Cancellation of trip $5,000

World Nomads Reviews

3.6 on Trustpilot – Many negative reviews recently stated that customer service was terrible and claims were denied. It seems that recent changes have been made at World Nomads and customers are not happy. Hopefully this changes soon again!

Pros

- Extensive coverage for a small price

- Cover for theft or damage to possessions

- Coverage for a wide range of sporting activities

Cons

- Not Flexible

- Terrible reviews

- Seems like it is very hard to make claims

👉 Check out World Nomads travel insurance for digital nomads here 👈

Conclusion on the best travel insurance for digital nomads

Insurance is something that is easy to put off but you never know when you will need it. So it’s better to sort it out before an accident happens.

Being clear about what you need and expect from an insurance provider will help you narrow down the options. Because many insurers nowadays offer tailored plans for nomads. Yeah!

We went for SafetyWing because it fulfills all our needs and we can recommend it because we had a good claim experience.

To find the right plan for you make sure to consider the 7 factors we listed at the beginning of this blog post and voilá you will be an insured nomad soon.

I hope that this review helped you to find the best company to get nomad insurance. If so or if you have any questions let me know in the comments down below!

READ ALSO

- Best cities in Mexico for digital nomads

- How to find housesits as a digital nomad

- How to stay fit while traveling full-time

- How to eat healthy and cheap while traveling

Hey there! Some of the links on this page are affiliate links. This means that if you choose to make a purchase we may get a small commission at no extra cost to you. These commissions help us to generate income and keep creating content for you. So we greatly appreciate your support! Thanks!

Hi, I am Allan, a travel, health and fitness fanatic from New Zealand. I'm a former lawyer who turned into a full-time nomad in 2020. For the last 4+ years I've been traveling the world. I'm always on a hunt for good food, activities on a budget and workouts on the go. I hope you find my tips helpful and get inspired to travel more!

You have made a wonderful compilation. Thank you.

Hi Gökçe, great to hear you found our review of insurances for nomads helpful. We will keep it updated 🙂

Best overview I have been able to find on this subject. Thanks so much for your effort putting together this compilation. Very appreciated!

Hi Cathy, thanks so much for your nice comment! We are really happy to hear that our blog post has helped you out 🙂